The second part of this summary focuses on Czech Republic. (part 1 – Poland, part 3 – Hungary, part 4 – Lithuania, part 5 – Ukraine)

Population: 10.3 mln

Internet users: 5.1 mln (50%)

Czech Republic is almost 5 times smaller than Poland, but has much better Internet penetration with 50% of its citizens connected to the Web.

Czech Republic has, similar to Poland, great and very strong Mozilla community (CZilla) founded in 2002. Group of project members with huge experience guarantees high quality and on-time releases with similar set of end-user oriented support features like we can see in Poland.

As I mentioned in part 0 of this article, Gemius has lower penetration here than for Poland. So while it still seems to be very representative, more data sources would be very useful.

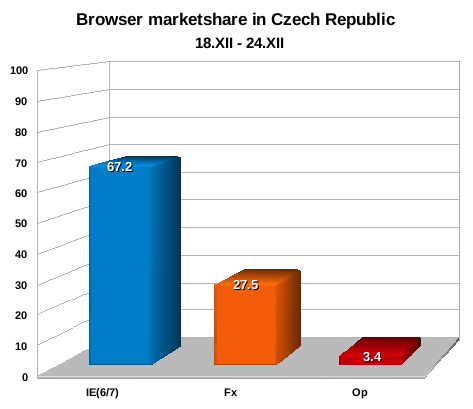

Let’s start the graph show with current market situation.

IE has a strong position with 67.2% which is 7.7% more than in Poland and even more than in the Polish emigrants group. Firefox has 27.5% – 5.8% less thanin Poland.

Firefox with over 1/4th and IE with 2/3rd are shaping the whole market.

To answer the question about how fast the Czech market is adopting new technologies, we can take a look at the versions graph: